For many property owners, the idea of signing a 25-year cell tower lease is appealing. It promises a steady stream of income with minimal involvement, creating the illusion of a low-risk, high-reward investment. However, beneath the surface, these leases may not be as secure as they appear. In fact, holding onto a cell tower lease for the full term might expose you to significant financial risks that could far outweigh the benefits.

After reviewing over 23k cell tower leases, and helping numerous cell tower owners navigate the complexities of their lease, one critical insight has become clear: Cashing out early and reinvesting the proceeds often presents a far more lucrative and safer strategy. In this expanded guide, we’ll explore not only the financial opportunity costs but also the hidden risks that make long-term cell tower leases a much more precarious investment than many realize.

Contents

- 1 The Illusion of Stability: The Real Risks Behind Cell Tower Leases

- 2 Cashing Out: Securing Your Financial Future

- 3 Investment Scenarios: Comparing Cell Tower Lease Income vs. Reinvestment Returns

- 4 Maximizing Returns Through Reinvestment

- 5 The Portfolio Effect: Spreading Risk Across Multiple Investments

- 6 Why Now Might Be the Best Time to Sell

- 7 Conclusion: Rethinking Your Long-Term Strategy

The Illusion of Stability: The Real Risks Behind Cell Tower Leases

At first glance, a 25-year cell tower lease might seem like a rock-solid investment. You’re promised $3,000 per month, with a 3% annual increase, which adds up to a tidy sum of around $1.3m over the lease term. However, this perceived stability is often misleading. Here’s why:

- High Risk of Lease Cancellation: Despite the 25-year term, most cell tower leases come with a clause that allows the tenant to cancel the lease with just 30 days’ notice. This means that your seemingly secure income stream could vanish almost overnight, leaving you scrambling to replace it. Given the high stakes involved, the risk of a lease cancellation is not just theoretical—it’s a very real possibility.

- Scarcity of Replacement Tenants: The telecommunications industry is highly competitive, and cell towers are typically placed strategically to cover specific areas. If your tenant cancels the lease, it’s often because they’ve found a more optimal site nearby. Unfortunately, this also means that your chances of finding a new tenant are slim. Once a site is vacated, it’s unlikely you’ll ever lease it again, effectively rendering the property a non-performing asset.

- High Chance of Rent Reduction: Even if your cell tower lease isn’t canceled, there’s a significant risk that your rent could be reduced. Carriers are well aware of their negotiating power, and they rarely agree to pay more than around $4,000 per month for a lease. In fact, they often pressure landlords to accept rent reductions, threatening to move their equipment to another site if their demands aren’t met. As a result, many property owners have seen their rents slashed to an average of $1,500 per month, drastically reducing the expected returns. This risk of rent reduction further undermines the long-term financial security of holding onto a cell tower lease.

Cashing Out: Securing Your Financial Future

Given the risks associated with long-term cell tower leases, it’s wise to consider the benefits of selling your lease while it still holds substantial value. By cashing out now, you can sidestep the uncertainties and potential financial pitfalls that come with holding onto the lease for its full term. But cashing out doesn’t necessarily mean relinquishing your rights to the property forever.

Options for Cashing Out

- Perpetual Sale for Maximum Payout: If you’re looking for the highest possible payout, you might consider selling the lease outright in a perpetual sale. In this scenario, you transfer all future rights associated with the property, ensuring that you receive a significant lump sum payment. This option provides immediate financial security and allows you to reinvest the proceeds into other, potentially more profitable opportunities.

- Term-Limited Easements: However, if you want to retain some long-term control over your property, there are alternatives. You can negotiate a term-limited easement or lease, typically for 55 or 60 years. Under this arrangement, you receive a substantial payout similar to what you might get from a perpetual sale, but with the added benefit of the easement or lease reverting back to you after the agreed-upon period. This option allows you to unlock significant value now, while still preserving future opportunities to lease the property again or sell it at that time.

Making the Right Decision for Your Financial Goals

Ultimately, the decision to cash out, whether through a perpetual sale or a term-limited easement, depends on your personal financial goals and how much control you wish to retain over the property. By understanding and weighing these options, you can make an informed choice that secures your financial future while aligning with your long-term vision for the property.

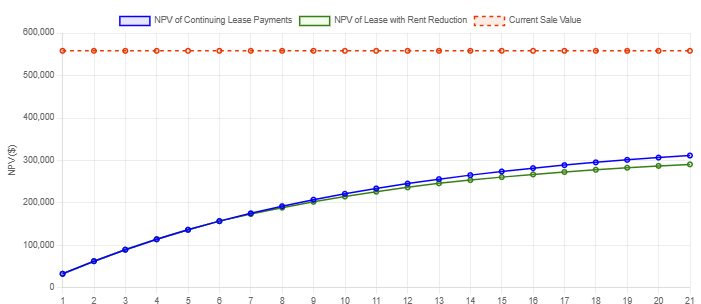

Investment Scenarios: Comparing Cell Tower Lease Income vs. Reinvestment Returns

Now, consider selling your lease instead. Depending on the location, lease terms, and market conditions, for a 3k/m lease and 3% escalator, you might receive a lump sum payment of around $558,000. By reinvesting this lump sum into a diversified portfolio, such as stocks, bonds, or real estate investment trusts (REITs), you could potentially achieve higher returns over the 25-year period.

| Investment Option | 5 Years | 10 Years | 15 Years | 20 Years | 25 Years | Risk Level |

|---|---|---|---|---|---|---|

| Holding the Lease | $102,000 | $220,500 | $358,500 | $519,000 | $702,000 | High Risk |

| 25-Year Treasury Bonds | $558,000 | $639,000 | $720,000 | $801,000 | $882,000 | Risk-Free |

| Commercial Real Estate REIT | $635,000 | $831,000 | $1,053,000 | $1,338,000 | $1,689,000 | Moderate |

| Balanced Investment Portfolio | $656,500 | $902,500 | $1,247,500 | $1,733,500 | $2,422,000 | Moderate – High |

| S&P 500 Index Fund | $707,500 | $1,052,000 | $1,568,000 | $2,330,500 | $3,474,000 | Moderate – High |

Disclaimer: All investments involve risk. This chart is for illustrative purposes only and should not be taken as financial advice. Please consult with a qualified financial professional before making any investment decisions.

As illustrated, the potential returns from reinvesting a $558,000 lump sum into a diversified portfolio could far exceed the income from holding the cell tower lease, especially when factoring in the high risk of lease cancellation.

Maximizing Returns Through Reinvestment

Instead of holding onto a high-risk lease that could be canceled at any time, you now have the opportunity to reinvest this capital in a way that could yield higher returns with more security.

Here’s why this strategy could be more advantageous:

- Higher Returns and Reduced Risk: As we discussed earlier, reinvesting in a diversified portfolio can offer significantly higher returns than the modest 3% annual increase from the lease. Moreover, by spreading your investments across different asset classes, you reduce your exposure to the risk of any single asset’s underperformance.

- Liquidity and Flexibility: Cashing out provides you with liquid assets that you can reallocate as needed. Whether the market shifts, your financial situation changes, or new investment opportunities arise, having cash on hand allows you to act quickly and strategically—something that’s impossible with a long-term lease.

Re-Invested Financial Analysis

The following projection assumes the full re-investment of all cell tower lease rents throughout the lease at a 2% interest rate and the re-investment of the sale value at a 5% interest rate.

| Year | Rent Re-Invested at 2% w/o Reduction ($) |

Rent Re-Invested at 2% w/ Reduction ($) |

Sale Value Re-invested at 5% |

|---|---|---|---|

| 2024 | $36,720.00 | $36,720.00 | $558,000.00 |

| 2025 | $75,276.00 | $75,276.00 | $585,900.00 |

| 2026 | $115,737.77 | $115,737.77 | $615,195.00 |

| … | |||

| 2041 | $1,006,813.98 | $921,667.25 | $1,278,946.22 |

| 2042 | $1,089,463.60 | $990,736.41 | $1,342,893.53 |

| 2043 | $1,175,641.62 | $1,062,706.01 | $1,410,038.21 |

| 2044 | $1,265,474.85 | $1,137,679.66 | $1,480,540.12 |

| 2045 | $1,359,094.37 | $1,210,231.26 | $1,554,567.13 |

| Total Revenue | $1,099,324.09 | $967,972.45 | $558,000.00 |

| Interest Earned | +$259,770.28 | +$242,258.81 | +$996,567.13 |

| Total Net Income | $1,359,094.37 | $1,210,231.26 | $1,554,567.13 |

| Difference | $-195,472.76 | $-344,335.87 | $0.00 |

The Portfolio Effect: Spreading Risk Across Multiple Investments

Another significant advantage of selling your lease and reinvesting the proceeds is the ability to diversify your investments. This strategy, known as the “Portfolio Effect,” reduces the risk associated with any single investment by spreading your capital across various asset classes. Diversification not only mitigates risk but also enhances the potential for higher returns, creating a more resilient and balanced financial portfolio.

One of the most compelling reasons to cash out of a cell tower lease is the opportunity to diversify your investments. The telecommunications industry is dynamic and often unpredictable. By holding onto a single lease, you’re essentially putting all your eggs in one basket, which can be incredibly risky given the potential for lease cancellation and the scarcity of replacement tenants.

In contrast, selling your lease and reinvesting the proceeds across a range of asset classes—such as stocks, bonds, real estate, and more—can help mitigate these risks. This approach, known as the “Portfolio Effect,” leverages diversification to create a more stable and resilient financial strategy. You’re not relying on the success of a single asset; instead, you’re spreading your risk and maximizing your potential for returns.

Why Wireless Equity Group Buys These Leases: Leveraging the Portfolio Effect on a Larger Scale

At Wireless Equity Group (WEG), we recognize the inherent risks that individual property owners face when holding onto a single cell tower lease. Our business model is built on the principle that the more assets we acquire, the more we can mitigate these risks. As an infrastructure fund, we’re focused on purchasing thousands of leases across the world, which allows us to spread risk across a broad portfolio of assets.

By aggregating a large number of leases, WEG is able to absorb the financial impacts that might devastate an individual property owner. Whether it’s the risk of lease cancellation, tenant relocation, or rent reduction, the diversified nature of our portfolio ensures that no single event can significantly destabilize our financial standing. This approach not only protects our investments but also allows us to offer more stable and competitive terms to property owners considering selling their leases.

Why Now Might Be the Best Time to Sell

The market for cell tower leases is currently strong, with investors and portfolio companies eager to acquire these assets. This demand presents a unique opportunity for property owners to secure a favorable sale price. However, market conditions can change, and the value of your lease may not be as high in the future—especially if your tenant cancels the lease or if the telecommunications landscape shifts.

By selling now, you lock in today’s value and avoid the potential downsides of holding the lease long-term. This strategic move can provide you with a significant lump sum that you can use to build a diversified, growth-oriented investment portfolio.

Why Sell to Wireless Equity Group?

For property owners, selling your lease to Wireless Equity Group offers several advantages:

- Immediate Financial Gains: You can secure a significant lump sum payment now, rather than waiting for income over the life of the lease. This allows you to reinvest in other opportunities with potentially higher returns.

- Reduced Risk Exposure: By selling your lease to us, you remove the risks associated with tenant cancellation and the difficulty of re-leasing. Our large-scale portfolio absorbs these risks, allowing you to focus on other financial goals.

- Expert Management: Wireless Equity Group’s expertise in managing a vast portfolio of leases ensures that your property is in capable hands. We optimize the value of each asset, leveraging our experience and market knowledge to achieve the best outcomes. With over 20 years in real estate ownership and management, our executive team understands the dynamic landscape of real estate investments.

In essence, Wireless Equity Group offers a win-win solution: property owners can cash out and reduce their exposure to risk, while we enhance the strength and resilience of our portfolio. By leveraging the Portfolio Effect on a large scale, we turn individual risks into collective stability, benefiting all parties involved.

Conclusion: Rethinking Your Long-Term Strategy

While a 25-year cell tower lease might seem like a low-risk, high-reward investment, the reality is far more complex. The risks of lease cancellation, the difficulty in finding replacement tenants, and the opportunity costs of tying up your property in a single, precarious income stream all suggest that holding onto the lease may not be the best financial decision.

Cashing out now and reinvesting the proceeds in a diversified portfolio could offer you higher returns, greater financial control, and reduced risk. In today’s ever-changing economic landscape, this strategy provides the flexibility and security that a long-term lease simply cannot.

As you consider your options, think about your broader financial goals and the level of risk you’re willing to tolerate. By taking a proactive approach and rethinking your investment strategy, you can position yourself for a more secure and prosperous financial future.